Multimedia content

- Images (1)

- AFC announced its strongest financial performance to date, with total revenue for the year ended 31 December 2024 surpassing US$ 1 billion for the first time in the Corporation’s history

- All (1)

Africa Finance Corporation Tops US$1 Billion Revenue for First Time as Landmark Projects Unlock Growth Across the Continent

AFC’s earnings growth was driven by improved asset yields, prudent cost-of-funds management and sustained traction in advisory mandates

These results send a clear message that strategic investment in African infrastructure creates lasting value for both beneficiaries and investors

Africa Finance Corporation (AFC) (www.AfricaFC.org), the continent’s leading infrastructure solutions provider, has announced its strongest financial performance to date, with total revenue for the year ended 31 December 2024 surpassing US$ 1 billion for the first time in the Corporation’s history.

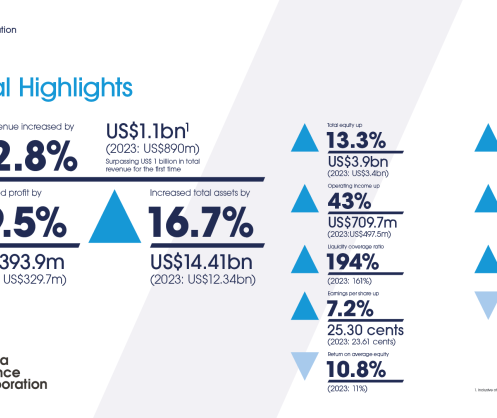

This record performance marks a significant milestone in AFC’s mission to close Africa’s infrastructure gap through scalable, de-risked investments that attract global capital and deliver tangible development outcomes. The Corporation posted a 22.8% increase in total revenue to US$1.1 billion and a 22.3% rise in total comprehensive income to US$400 million, up from US$327 million in 2023.

AFC’s earnings growth was driven by improved asset yields, prudent cost-of-funds management and sustained traction in advisory mandates.

Further significant financial highlights include:

- Net interest income up 42.5% to US$ 613.6 million

- Fee and commission income rose to US$109 million, the highest in over five years

- Operating income climbed 42.7% to US$709.7 million

- Total assets reached a record US$14.4 billion, a 16.7% year-on-year increase

- Liquidity coverage ratio strengthened to 194%, providing over 34 months of cover

- Cost-to-income ratio improved to 17.3% from 19.6% in 2023

Throughout 2024, AFC continued to scale its impact by mobilising capital for landmark projects across energy, transport, and natural resources. These included the Lobito Corridor – a cross-border railway development spanning Angola, the Democratic Republic of Congo (DRC), and Zambia. AFC led the initiative to secure a concession agreement within one year of the initial Memorandum of Understanding (MoU), an unprecedented achievement for a project of its scale. In the DRC, AFC also invested US$150 million in the Kamoa-Kakula Copper Complex, Africa’s largest copper producer and one of the most sustainable globally, thanks to its high-grade ore and renewable-powered smelter.

Other milestones transactions included financing support for the commissioning of the Dangote Refinery, the largest in Africa, and continued progress on AFC-backed Infinity Power Holding’s 10 GW clean energy ambition, with power purchase agreements secured in Egypt and South Africa. AFC also invested in the 15GW Xlinks Morocco-UK Power Project, providing US$14.1 million to support early-stage development of a transcontinental renewable energy pipeline between North Africa and Europe.

AFC strengthened its capital base and expanded its investor network through several landmark funding initiatives. These included a US$ 1.16 billion syndicated loan - the largest in its history, a US$500 million perpetual hybrid bond issue, and the successful execution of Nigeria’s first-ever domestic dollar bond, which raised US$900 million at 180% oversubscription. AFC also returned to the Islamic finance market after eight years, closing a US$400 million Shariah-compliant facility.

The year also saw strong momentum in equity mobilisation, with US$181.8 million in new capital raised from ten institutional investors. These included Turk Eximbank - AFC’s first non-African sovereign shareholder - the Arab Bank for Economic Development in Africa (BADEA), and several major pension funds spanning Cameroon, Seychelles, Mauritius, and South Africa. Ratings agencies affirmed AFC’s robust credit profile, with AAA ratings from S&P Global (China) and China Chengxin International, and a stable A3 Outlook from Moody’s.

“These results send a clear message that strategic investment in African infrastructure creates lasting value for both beneficiaries and investors,” said Samaila Zubairu, President & CEO of AFC. “In 2024, we exceeded the billion-dollar revenue mark, delivered game-changing projects, and reinforced our financial resilience—demonstrating the scalability of our unique model that blends purpose with performance to accelerate Africa’s economic transformation.”

Read the full annual report here (https://apo-opa.co/424qlmR)

Distributed by APO Group on behalf of Africa Finance Corporation (AFC).

Media Enquiries:

Yewande Thorpe

Communications

Africa Finance Corporation

Mobile: +234 1 279 9654

Email: yewande.thorpe@africafc.org

About AFC:

AFC was established in 2007 to be the catalyst for pragmatic infrastructure and industrial investments across Africa. AFC’s approach combines specialist industry expertise with a focus on financial and technical advisory, project structuring, project development, and risk capital to address Africa’s infrastructure development needs and drive sustainable economic growth.

Seventeen years on, AFC has developed a track record as the partner of choice in Africa for investing and delivering on instrumental, high-quality infrastructure assets that provide essential services in the core infrastructure sectors of power, natural resources, heavy industry, transport, and telecommunications. AFC has 45 member countries and has invested over US$15 billion in 36 African countries since its inception. www.AfricaFC.org